Author: Sebastian Arthofer, MSc BSc

Are you looking for a private health insurance in Austria and want to get simple and easy to understand information?

At the same time you would like to have specialized experts who can help you find the best tarif?

You have come to the right place!

In this article we answer the 9 most frequently asked questions about private health insurance (also known as “Private Krankenversicherung” or “Zusatzversicherung” in Austria) and at the same time we compare the premium with you in a free consultation.

Before we start though, let’s get an overview with the 7 most important points about private health insurance in Austria.

Let’s go.

P.S.: No time to read? Just use our explainer video (in German).

Costs

The private health insurance (elective doctors & private hospitals) costs:

Your age and health condition drives the price.

Pay attention before signing!

Rates more expensive than 100 € regardless of age are only recommended in exceptional cases

How it works

Private health insurance is taken out in addition to the statutory health insurance of ÖGK, SVS or BVAEB.

It is a voluntary insurance and can be taken out with the 7 private health insurance companies in Austria.

Coverage

It consists of 3 components:

Benefit

The private insurance fully covers the costs of elective/private doctors and the special class "Sonderklasse" or private hospital during a hospital stay.

Furthermore, services such as private physiotherapy, mother-child-pass examinations and similar are insured.

Which one is the best?

The best private health insurance is the combination of elective/private doctor insurance including the coverage for the private hospital after an accident and an option for illness.

Why? It is affordable and acutely covers the most important points at the elective doctor and in the hospital.

For whom does it make sense?

Private health insurance makes sense for people between 0 and 45 years.

The earlier you sign the contract the cheaper the premium and the healthier you usually are.

Realistic private doctor costs

Make sure you contract covers a realistic amount for private doctors.

We recommend contracts with an coverage between 1.300€ and and 1.400€ which corresponds to the average of our customers.

Your advantages

Short waiting times at the doctor and for operations because you can use private doctors and the private hospital.

The time saving and the quick and easy appointment are further advantages.

This is the best way to proceed

👉 The private health insurance can become extremely complex without an overview of the market. Book yourself a free, no-obligation consultation and be advised by our specialists with the experience of several thousand insurance comparisons. Consultations are free of charge and can be held in English.

You are here: Startseite > Ratgeber > Vergleich

Before we go into detail about all the components of private health insurance, let’s clarify how private insurance works?

Here we go.

Let’s get an overview of what private health insurance is, how it works and how it can be distinguished from the statutory health insurance.

Private health insurance versus statutory health insurance

Private health insurance (PKV) in Austria is a form of health insurance that is taken out voluntarily in addition to statutory health insurance (GKV), and where the insured have their costs for private services, such as elective doctors or private hospital covered.

As a rule, the insured pays monthly premiums to a private health insurance company, which in return covers the costs of medical treatment and services for them.

Private health insurance in Austria generally offers a higher range of benefits than public health insurance and can also be tailored to the individual needs of the insured.

Treatment by a panel doctor is covered by the health insurance, provided it is medically necessary(!).

In contrast…

To cover these costs, one takes out private health insurance. Elective physicians generally have a higher reimbursement rate than public health insurance physicians, but also often offer a higher level of comfort and more individualized care.

In Austria, there are different types of hospitals that offer different services and prices.

The prices for treatments in a private hospital are therefore individually negotiable and usually higher than in a hospital of the general fee category. However, private hospitals or even the “Sonderklasse” usually also offer a higher level of comfort (1 or 2 bed room) and more individualized care than hospitals of the general fee class.

The statutory health insurance only covers the general admission class whereas the private health insurance covers the private hospital or the special class.

Finally, you will now find a short explanatory video, which summarizes all the relevant points. (in German)

Finally, the question remains who offers private health insurance in Austria.

In Austria, there are several private health insurance companies that offer private health insurance.

The largest and best known providers of private health insurance in Austria include.

Is it actually worth comparing?

The different providers offer different coverages and prices, so it makes sense to get different quotes and compare them carefully before deciding on a particular private health insurance.

To get a feel for the size of each insurance company here, below you will find the market shares of private health insurance in Austria.

The market shares of private health insurance are as follows:

Wahlarztversicherung

Du erhältst ein Haushaltsbudget im Kalenderjahr und kannst dir deine Kosten beim Wahlarzt bzw. Privatarzt rückerstatten lassen. Nebenleistungen, wie Physiotherapie, Massagen und Heilbehelfe werden zusätzlich rückerstattet.

Sonderklasseversicherung

Die private Krankenversicherung übernimmt deine Kosten im Privatspital oder auf der Sonderklassestation. Die Tarife unterscheiden sich, ob du nach Unfall oder nach Krankheit versichert bist.

Zusatzleistungen

Leistungen wie eine Babyoption, Einbettzimmer oder ein Reisetarif können typischerweise nur in der Kombination mit einer Wahlarztversicherung oder Sonderklasseversicherung abgeschlossen werden und sind somit Zusatzpakete.

In essence, private insurance in Austria takes care of 4 specific benefits. The benefits of private health insurance are as follows:

Full coverage of elective medical expenses means that an insurance company covers 100% of the costs of treatment by an private doctor chosen by the insured (as opposed to a panel doctor suggested by the public health insurance company).

In addition to 100% coverage of elective physician services, private health insurance typically covers the following additional services:

These services are fully or partially covered depending on the plan.

Diese Leistungen sind abhängig vom Tarif vollständig oder teilweise übernommen.

In addition to the elective doctor insurance module, private health insurance can also include special class insurance or private hospital insurance. In this case, 100% of the costs are covered. The following benefits are covered:

If your child is admitted to hospital and you wish to be with your child in a single or double room, costs are generally covered.

Provided your child has special class insurance, this policy will also cover your additional costs for hospitalization.

Is private health insurance worthwhile?

The question of whether private health insurance is worthwhile is often hotly debated.

If the benefits of the statutory health insurance are sufficient for you, then the conclusion of a private health insurance is probably less sensible.

Private health insurance can offer benefits in certain cases, such as access to elective doctors and shorter waiting times for certain treatments and operations in private hospitals.

These benefits are only covered by private health insurance.

But is it worth it for me individually?

In the next section, we show you per age group what considerations many of our customers had when taking out private insurance.

We will address the following age groups:

Meanwhile, almost all young parents insure their newborns. This is mainly due to the fact that there are almost no public doctors left in the metropolitan areas.

In addition, regular Mother-Child Passport examinations at an elective pediatrician are relatively expensive over time.

In the first year alone, you’ll have to take your newborn to the doctor 5 times. This alone accounts for costs of over €500.

Who does not know it?

Once the fall season starts, the little ones are sick much more often. And when they enter kindergarten, this becomes even more intense.

In kindergarten, your child is regularly exposed to new bacteria and if you don’t have a trusted doctor with available appointments, the regular visits can become “torture.”

Also, don’t overlook the increased costs associated with regular visits to an elective doctor.

Have you ever had to wait in a crowded waiting room for your appointment?

Now imagine this situation with your newborn or toddler.

With overcrowded waiting rooms, on the one hand, the further risk of infection is higher, and on the other hand, the unnecessary time has to be bridged.

Private health insurance allows you to use elective physicians free of charge, where there is typically no waiting time in the office.

This reduces the risk of infection for your child and also saves valuable life time.

As your child gets older, visits to the doctor are more likely to change.

In the past it was the regular mother-child check-ups, but at a young age, due to the increased risk of leisure time, a visit to the hospital or due to growth, a visit to the doctor is quickly possible.

Is private health insurance worthwhile for young people?

An important component at a young age is social integration.

Thus, many children join sports clubs or similar and can develop well socially there.

But increased leisure activities also increase the risks of injury.

Quickly once

In many of these situations, parents and teenagers alike do not want to wait forever at the doctor’s office and have a trusted doctor at their side even for more complicated fractures.

Also the stay in the hospital should take place in peace and security and not in the 4 or 8 bed room, where the neighbor snores the latest Justin Bieber song.

And also your company in the hospital should not cause any further costs.

Many of these points are thereby uncomplicatedly covered by private health insurance

Similar to babies, teenagers don’t want to have to sit out their time at the doctor’s office, and with increased school stress and puberty, there are other new challenges that may require psychological support.

But the choice of doctors and getting second opinions should not be underestimated at this age.

sollte in diesem Alter nicht unterschätzt werden.

Once the first money has been earned, life is certainly easier after training or studies.

However, if injuries happen again and again at a young age – due to sports – one quickly comes into contact with the system of statutory health insurance.

And many young – motivated professionals – don’t want to wait weeks to recover from their latest accident.

If your parents have not yet made health provisions for you at a young age, many young sporty adults between the ages of 20 and 30 are looking into private health insurance.

The first money is earned, but to spend this completely for the insurance, does not float many.

One point should always be kept in mind: the earlier one takes out private health insurance, the more favorable the premium.

Even over a lifetime.

But how is that possible?

Quite simply.

Your young contract will only be adjusted for inflation over the years.

A new contract always includes the age risk and thus the premium increases quickly exponentially – i.e. more than inflation – especially for people over 45.

Especially in your younger years, leisure time is probably more important to you than sitting safely for hours in an office waiting for the free appointment with the doctor.

But also the regular checkups at the ENT doctor or at the ophthalmologist should be done without long waiting times in the office.

And also in the professional context, many young professionals are interested in quickly becoming active again in the job for which they have put up with years of training or even study.

For many people who are between 30 and 40 years old, private health insurance is a good way to protect their health.

Those who have income from their jobs can take advantage of the benefits of private health insurance.

One of the biggest advantages of private health insurance is that it offers a certain amount of flexibility. For example, you can decide which treatment methods you want to use and also which services you can afford.

In addition, private health insurance often offers more benefits than other types of insurance. This means that in the event of an illness, one receives more support and recovers more quickly.

Private health insurance in Austria is a great way to get appointments quickly and easily.

Many doctors often admit privately insured patients directly into the treatment room, which can significantly reduce waiting times.

Many doctors are also more flexible than those with public health insurance when it comes to scheduling appointments. As a rule, you do not have to wait long for a doctor’s appointment.

And flexible office hours are especially important for working people, so that they can have the appropriate examinations after work or at the weekend.

And finally, it must be said that the quicker the appointment with the doctor, the quicker the recovery typically is.

Many adults complain about persistent everyday stress at work.

And especially with the increased digitalization and the accompanying fast-paced everyday life, psychological problems can also arise again and again due to stress.

Here, private health insurance can help to use private psychological care or coaching and consciously address the fears or problems.

And possibly also once the assumed massage helps to escape from everyday life and enjoy a few quiet minutes.

Possibly you have already had the situation. You are riding with your loved ones and suddenly you crash your bike.

The hand hurts, but you continue riding.

The next day, the hand swells more and more and it becomes clear to you: you need to see a doctor.

Your friends already have experience with a special accident orthopedist whom you consult.

The doctor convinces you with her professional competence and comes to the conclusion that your hand is unfortunately broken. And it is also relatively complicated.

She suggests that you have the operation done in a private hospital.

Your doctor is always by your side and the operation goes without complications.

After a few weeks your hand is completely healed.

And it is these steps, having the trusted doctor with you throughout the process, that many customers find particularly important.

2 concrete examples for you

To start with: private health insurance in Austria costs on average about 30€ per month for children and about 45€ to 100€ for adults.

Tariffs significantly above 100€ can be useful for the following situation:

However, here too there are major differences between insurance companies.

Now that we have a rough understanding of what private health insurance costs, the question arises as to what specifically influences the premium.

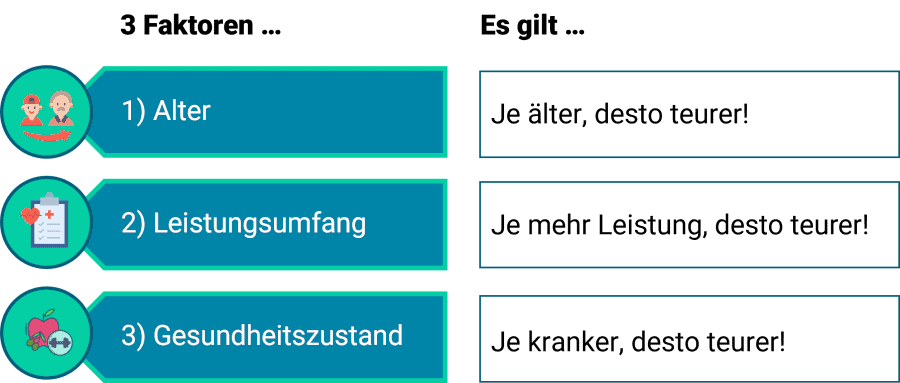

Decisive for the amount of the premium in private health insurance are 3 important parameters:

⇒ The younger, the cheaper.

The earlier you join a private health insurance policy, the cheaper the premium will be.

An existing health insurance contract is adjusted annually only with inflation per year. There are no other adjustments.

A newly concluded contract includes the age risk. Especially contracts with a conclusion after 45 years increase, per year exponentially.

⇒The more benefits, the more expensive the premium.

For the elective doctor tariff (BASIS), the higher the “elective doctor budget”, the more expensive the tariff.

If you extend your elective doctor solution with the special class after accident with the option of illness, the premium in the package (COMFORT) increases only minimally. By combining an elective doctor’s tariff with private hospital insurance, you can save up to 30% in premiums. This is the so-called combination discount.

Probably the biggest difference in the premium is when an elective doctor tariff with the special class after accident and illness is concluded (PREMIUM). This is the largest solution in Austria.

If you want to know more about the difference between the individual benefits in private health insurance, I recommend our explanatory video: the 3 packages of private health insurance.

Age | Basis 💡 | Comfort 🔮 | Premium 💎 |

|---|---|---|---|

Kind | 30 - 53 € | 32 - 48 € | 44 - 62 € |

20 | 51 - 86 € | 51 - 99 € | 109 - 154 € |

30 | 61 - 96 € | 60 - 120 € | 135 - 190 € |

40 | 65 - 98 € | 76 - 137 € | 159 - 224 € |

As you can see, the premium range between insurances can differ greatly. That’s why we always recommend an insurance comparison.

AND, sometimes it all comes down to the finer points.

If you are still undecided about which concept and which insurance fits your needs exactly, we can help you in a free and non-binding online consultation.

Our experts have more than 2,000 consultations under their belt and will be happy to discuss your individual situation with you. They are all trained exclusively for private health insurance and do not deal with any other topics.

⇒ The sicker, the more expensive.

If you’re looking to purchase private health insurance, your current and past health status also plays a role.

The premiums you see when you make an offer or prepare an application are assuming you are in the best of health.

Only with the preparation of the application you will also be sent health questions.

You should fill these in to the best of your knowledge. And depending on your pre-existing conditions, the premium may then increase accordingly.

Therefore, the conclusion of a private health insurance at a young age is also highly recommended due to the state of health.

Now you must be wondering what strategies you can use to save premium?

That’s easily answered:

Experience shows that our customers at krankenversichern.at need between €1,300 and €1,400 in elective physician cost budget.

This includes services of elective physicians (general practitioners as well as specialists), private MRIs, CTs and other ancillary services such as physiotherapy or psychotherapy.

This value is the average of all customers, and the amount does not change drastically with age. It is the composition of the costs that changes.

So when you are young you might use a sports doctor, but when you are older it is the orthopedist and physiotherapy.

With over 1,200 customers, this corresponds to very reliable figures.

As mentioned above, one strategy is to combine an elective doctor insurance with a special class insurance (COMFORT).

This has 3 main advantages:

Provision with upgrade without renewed health check: The option for illness allows you to upgrade to Premium without a renewed health check

Finally, if you are interested in the full coverage (PREMIUM), you should definitely agree on a deductible.

Why?

There are many providers where the deductible is waived, for example, in the following situations:

By agreeing on a deductible, you can save up to 50% premium.

What is the difference?

Statutory health insurance is the mandatory hospital and doctor’s care in Austria.

Every employee and self-employed person is compulsorily insured by law.

Private health insurance is taken out in addition to statutory health insurance.

Therefore, it is often referred to as supplementary insurance.

Here are the differences

Statutory Insurance | Private Heath insurance |

|---|---|

Compulsory insurance | Voluntary additional insurance |

Coverage of general fee class in the hospital | Coverage of special class or private hospital in the hospital |

4-8 bed room | 2 bed room |

Coverage at panel doctors | Coverage at private doctors/doctor of choice |

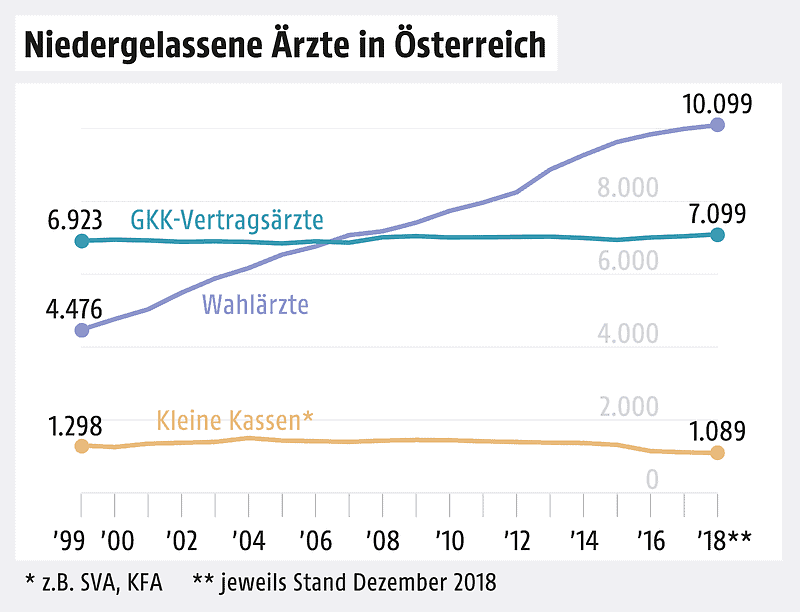

~ 8.000 panel doctors | ~11.000 private doctors |

Long waiting times for treatment and operations (weeks or months) | Short waiting times for treatment and operations (days) |

Reasons for private health insurance

“Are you supplementary insured or not!” – a saying you often hear when you are already sitting in a doctor’s crowded waiting room after many hours.

When it is finally your turn to describe your symptoms to the doctor, you realize that you have a maximum of 5 minutes because he is massively pressed for time, since there are many other patients sitting outside who need his help.

If you end up in the hospital because of an accident or because of an illness, then you are annoyed by the other room neighbors who are snoring the latest Justin Bieber hit at night.

If you say, no this nerve-wracking feeling both at the doctor and in the hospital is not for you, then you should think about taking out private health insurance.

The following reasons play an important role:

Ihre Vorteile

Private health insurance is a voluntary supplementary insurance to the statutory health insurance in Austria. It allows you to be reimbursed for the costs of treatment by an elective doctor and covers treatment in a private hospital or special class in a hospital.

The statutory health insurance is a compulsory insurance and covers the costs of panel doctors and the general fee class in the hospital. Private health insurance is taken out voluntarily and covers the costs of elective doctors and the private hospital.

The private health insurance has 3 components. The elective doctor insurance, the special class insurance and additional services (single room, baby option or travel tariff) of the private health insurance.

This depends mainly on how often you go to the elective doctor per year or how often you would like to go. As a rule, two to three visits to an elective doctor per year are sufficient. You can also significantly shorten waiting times for appointments or surgeries compared to the statutory health insurance physicians.

In principle, the amount of the premium depends on age and state of health. For a healthy 30-year-old person, however, you can expect to pay around €55 to €85 for a sensible insurance policy with the ideal range of benefits.

Privately insured persons have private health insurance in addition to statutory health insurance and can be fully reimbursed for the costs of elective physicians and use a private hospital.

The best private health insurance is currently an elective medical insurance with special class after accident and option for illness from Generali Krankenversicherung.

You choose your desired private health insurance from one of the 7 providers in Austria and apply for it with an insurance broker. Afterwards, your application goes through a risk assessment and if accepted positively, you will receive your policy.

No. With an insurance broker, you pay exactly the same price as with the insurance company directly and get independent advice on top of that. The commission is paid by the insurance company to the broker.

No. Only health questions must be answered. Performed during the underwriting process.

During the underwriting process, you may be contacted by a doctor from the insurance company and asked about certain of their health questions.

Yes, you can start receiving benefits as soon as you are covered by your elective plan. Depending on the insurance company, may be one point more or less in the policy in hand. Exceptions are here, however, special waiting periods (eg pregnancy treatments), which must be observed.

Kontakt

krankenversichern.at

AVERS Versicherungsmakler GmbH Bahnhofstrasse 54 4600 Wels, Oberösterreich, Österreich

E-Mail: [email protected] Telefon: 07242 219 880 Beratung: Termin online buchen

Unternehmen

Favoriten der Leser:

Private Krankenversicherung Österreich Private Zusatzversicherung in Österreich Private Krankenversicherung für die Schwangerschaft Privatarztversicherung - was muss ich wissen? Sonderklasseversicherung sinnvoll? Was kostet eine private Krankenversicherung? Krankenversicherung Grenzgänger: 3 Optionen Zahnversicherung - welche ist die Beste?